Hello! In this week’s ETF Wrap, you’ll get a look at flow data showing recent “bullish buying behavior” from investors, as well as funds to consider before 2024 hits.

Please send feedback and tips to christine.idzelis@marketwatch.com or isabel.wang@marketwatch.com. You can also follow me on X at @cidzelis and find me on LinkedIn. Isabel Wang is at @Isabelxwang.

Sign up here for our weekly ETF Wrap.

Investors in the exchange-traded-fund industry stopped piling into cash-like ultrashort duration government bonds last month, plowing money instead into riskier areas of the market. The catalyst was expectations for the Federal Reserve to cut interest rates next year, according to State Street Global Advisors.

“Bullish buying behavior returned to the market in November” and continued into December, said Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors, in a phone interview. Investors last month poured capital into ETFs that buy high-yield corporate bonds, or so-called junk debt, while returning to tactical bets in sector equity funds, he said.

At the same time, ultrashort duration government bond ETFs saw their first monthly outflows of the year in November, with investors continuing to pull capital from such funds this month through Dec. 5, according to Bartolini. The category had been raking in assets in 2023, after both stocks and bonds were hammered last year as the Fed raised rates.

Investors for the bulk of this year viewed ultra-short-duration government bonds as safe-haven assets. They also have the added benefit of attractive yields around 5%, following the Fed’s rate hikes aimed at bringing down inflation. For example, the SPDR Bloomberg 1-3 Month T-Bill ETF

was particularly popular in October.

As yields on ultra-short-term Treasury bills, or T-bills, are “closely connected to Fed policy,” they stand to decline should the Fed cut rates next year, said Bartolini. ETF investors are taking the opportunity to “re-risk” on expectations for rate cuts in 2024, making allocations to equities and below-investment-grade corporate debt last month, he said.

Related: Favoring 5% savings accounts and CDs over stocks now? Think again.

Heading into next year, investors should target “growth with quality” in U.S. equities, as the economy may slow due to higher rates, according to a 2024 ETF market outlook note from State Street.

Bartolini said that investors considering adding “quality” to their equities portfolio might consider the SPDR MSCI USA StrategicFactors ETF

,

which tracks large and midcap stocks in the U.S.

U.S. equities this year have overcome recession fears, led by U.S. large-cap growth, as “resilient” consumer spending supported economic growth, according to the State Street note.

Christian Magoon, chief executive officer of Amplify ETFs, said in a phone interview that his firm’s Amplify Online Retail ETF

has risen during the holiday shopping season. One of the fund’s top holdings is “buy now, pay later” business Affirm Holdings Inc.

AFRM,

he said.

Shares of the ETF, which climbed 4.6% last week, jumped more than 27% this year through Thursday, FactSet data show.

In an economic slowdown, online retailers may benefit from more “cost-conscious” consumers searching the internet for “the best deal,” said Magoon.

Within fixed income, State Street’s Bartolini said the SPDR DoubleLine Short Duration Total Return Tactical ETF

and the SPDR DoubleLine Total Return Tactical ETF

are investment strategies that may help balance income and stability in 2024.

The SPDR DoubleLine Short Duration Total Return Tactical ETF tends to have a duration between one and three years, which is longer than ultra-short-term bond ETFs, he said. It’s an option for “investors who have parked all that money in cash” and want to take more duration risk but in a measured way, he said.

The SPDR DoubleLine Short Duration Total Return Tactical ETF is an actively managed core strategy in fixed income, according to the State Street report.

Digging into ETF flows

Overall, U.S.-listed ETF flows in November were “really strong,” Bartolini told MarketWatch.

They attracted $94 billion last month, leaving their total flows this year just $40 billion away from $500 billion for 2023, according to a separate State Street note on ETF flows. That $500 billion “barrier” may be surpassed for a fourth consecutive year, Bartolini said.

While fixed income saw $27 billion of inflows in November, government bond ETFs suffered outflows for the first time this year — all of which was from the ultrashort funds, according to State Street. The inflows were “fueled by risk-on high yield taking in a best-ever $11 billion.”

By contrast, investors pulled $7.1 billion from ultra-short-term government bond ETFs last month, the report says.

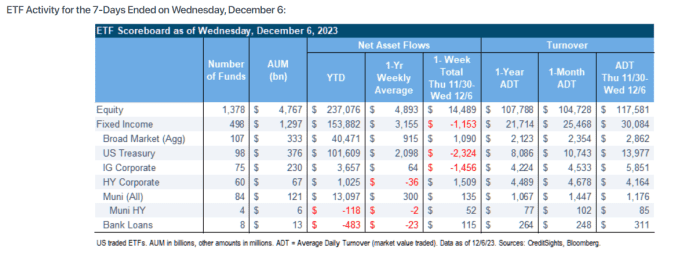

As for ETF flows into December, fixed income saw outflows led by U.S. Treasurys in the seven days ending Dec. 6, according to a CreditSights note on Thursday.

CREDITSIGHTS REPORT DATED DEC. 7, 2023

“Fixed income ETF lost assets for the second week in a row, something that hasn’t happened since February,” as outflows increased from U.S. Treasury and investment-grade corporate ETFs, CreditSights analysts said in the note.

As for equity flows in November, sector funds saw their first monthly inflows since July, cutting their net outflows this year in half, according to the State Street report. “Within sectors, cyclicals outpaced defensives amid this risk-on positioning,” Bartolini wrote in the report.

As usual, here’s your look at the top- and bottom-performing ETFs over the past week through Wednesday, according to FactSet data.

The good…

…and the bad

New ETFs

- Vanguard said Thursday that it launched the Vanguard Core-Plus Bond ETF VPLS and will list the Vanguard Core Bond ETF (VCRB) by year-end. Both are actively managed ETFs, the firm said.

-

Harbor Capital Advisors said Dec. 4 that it launched the Harbor Long-Short Equity ETF

managed by Disciplined Alpha LLC.