Last October, I wrote an article explaining why I had stopped buying rental properties to buy real estate investment trusts (REITs) instead. I argued that REITs were mispriced, offering an opportunity for investors to buy real estate at a discount to its fair value.

Since then, REITs have risen by 36% on average, even as private real estate has mostly stagnated or even slightly declined in value:

I would also add that this is just the average of the REIT sector, represented by the Vanguard Real Estate ETF (VNQ), which includes the good and bad.

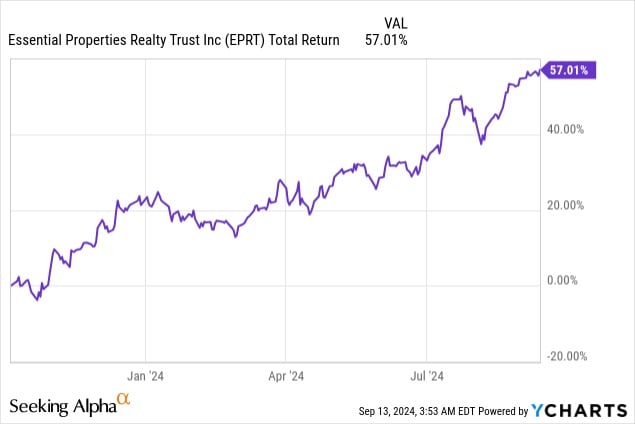

If you were selective and invested in the right REITs, you could have done a lot better. As an example, our largest REIT investment during this time period was Essential Properties Realty Trust (EPRT), and it is up 57% in just 11 months:

But are REITs still a compelling investment opportunity, or has the window for investing in them already closed?

I believe the former is true.

Even after the recent rally, a lot of REITs are still trading at large discounts relative to the fair value of their real estate.

Take the example of BSR REIT (HOM.U:CA), which I discussed in last year’s article. It’s an apartment REIT that specializes in rapidly growing Texan markets. It was priced at a whopping 42% discount back in October 2023 and has recovered somewhat since then, but still trades at a 24% discount today.

In other words, you can still buy an equity interest in the real estate of BSR at 76 cents on the dollar, a better deal than what you would get in the private market. It trades at ~6% implied cap rate, but its properties are worth closer to a ~5% cap rate in the private market.

But I think the days of REITs trading at large discounts are now numbered. The only reason REITs are priced as they are today is because the market overreacted to the surge in interest rates.

REITs generally use little leverage, and their fundamentals have not been heavily impacted. In fact, REIT cash flows and dividends kept rising in 2022, 2023, and so far in 2024, even despite the surge in interest rates.

However, it still caused their share prices to crash because a lot of income investors sold their REITs, regardless of their fundamentals, to reinvest in bonds and Treasuries instead. These investors were never truly interested in owning REITs, but they had invested in them to earn yield in a yieldless world. But as soon as bonds and Treasuries offered a decent yield, they sold, causing REITs to crash.

This is very clear if you look at the strong inverse correlation between REIT share prices and interest rates in this bear market:

But we will now see the opposite happen as interest rates return to lower levels, which is why REITs have begun their recovery.

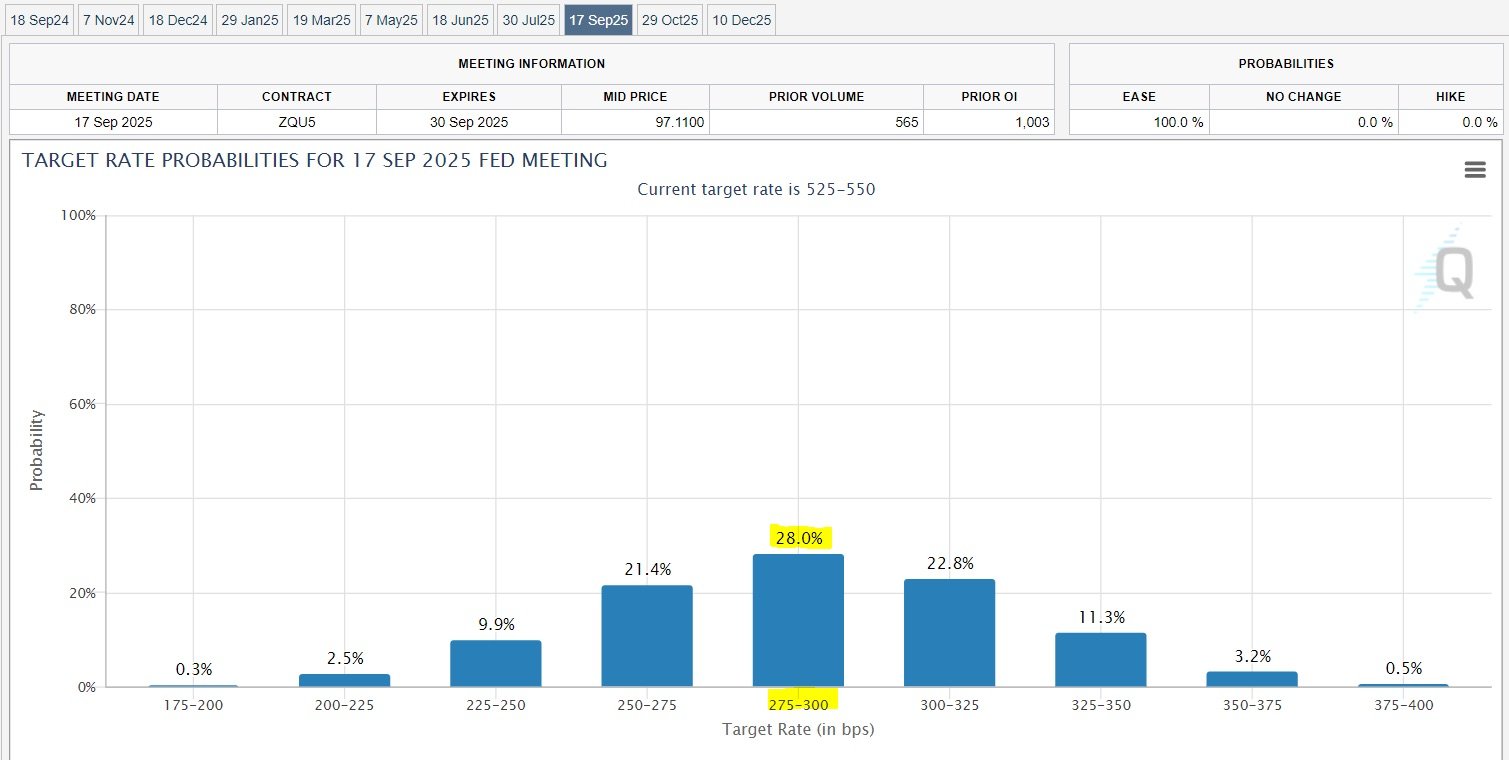

The debt market is predicting that interest rates will drop by roughly 250 basis points within a year from now:

This anticipation has already pushed some investors to reinvest in REITs, and as rates gradually return to lower levels, I expect many more investors to reconsider their fixed-income allocations and return to the REIT sector.

REITs are still relatively cheap, trading at discounts to their net asset values, and it is not uncommon to find good REITs still offering 5% to 7% dividend yields.

REITs were less tempting when you could get a 5% yield on money market funds and short-term Treasuries, but as that turns into 2.5% to 3%, REITs will become a hot commodity again.

How Much Upside Do They Offer?

Historically, REITs have typically traded at a slight premium to their net asset values, and this makes sense, given all the advantages they offer relative to private real estate.

You are essentially getting the best of both worlds, stocks and real estate, in one package, and that’s worth a premium:

| Private Real Estate | Public REITs |

|---|---|

| Illiquid | Liquid |

| Concentrated | Diversified |

| Costly, work-intensive management | Cost-efficient, professional management |

| Unlimited liability | Limited liability |

| Limited access to capital | Superior access to capital |

| Discount valuation | Premium valuation |

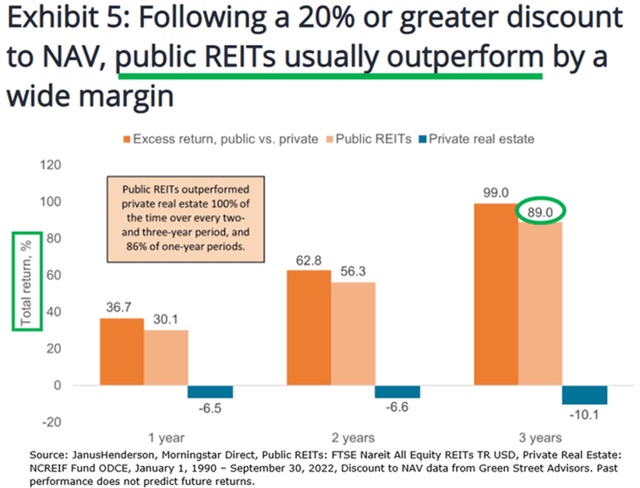

Yet there are still a lot of REITs that trade at a 25% to 50% discount relative to the fair value of their real estate, net of debt. This is ultimately why I have kept buying more REITs instead of rental properties.

I am not able to invest in the equity of rental properties at a 25% to 50% discount. This means that simply returning to their fair value could unlock 50% to 100% upside in some cases, and we now have a clear catalyst for this upside to be realized.

For this reason, I just don’t get the point of buying private real estate today. You are paying more to buy an illiquid, concentrated, private asset that’s management intensive and taking a greater liability risk to likely earn lower returns in the end.

Research studies clearly show that buying REITs at a discount is a strategy to earn much higher returns:

Follow the Leaders

But don’t take it just from me. The leading private real estate investment firm, Blackstone (BX), which controls over $1 trillion worth of assets, is today choosing to buy REITs instead of private real estate.

Earlier this year, it bought out Tricon Residential (TCN) and paid a 30% premium for it. Then, a few months later, it acquired Apartment Income REIT (AIRC) and paid a 25% premium for it. Now, it is rumored to be attempting to buy out a third REIT, Retail Opportunity Investments (ROIC), and this move has already caused its share price to surge by 25%.

Blackstone is spending tens of billions of dollars to acquire REITs because it is the cheapest real estate that it can buy today—so cheap that Blackstone is willing to pay ~30% premiums to their latest share prices and still think that it is getting a good deal.

I am following the same approach but on a smaller scale. As REITs recover, I will likely get back to buying private real estate eventually, but right now, I cannot make sense of it because REITs are so much more attractive.

Invest Smarter with PassivePockets

Access education, private investor forums, and sponsor & deal directories — so you can confidently find, vet, and invest in syndications.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.